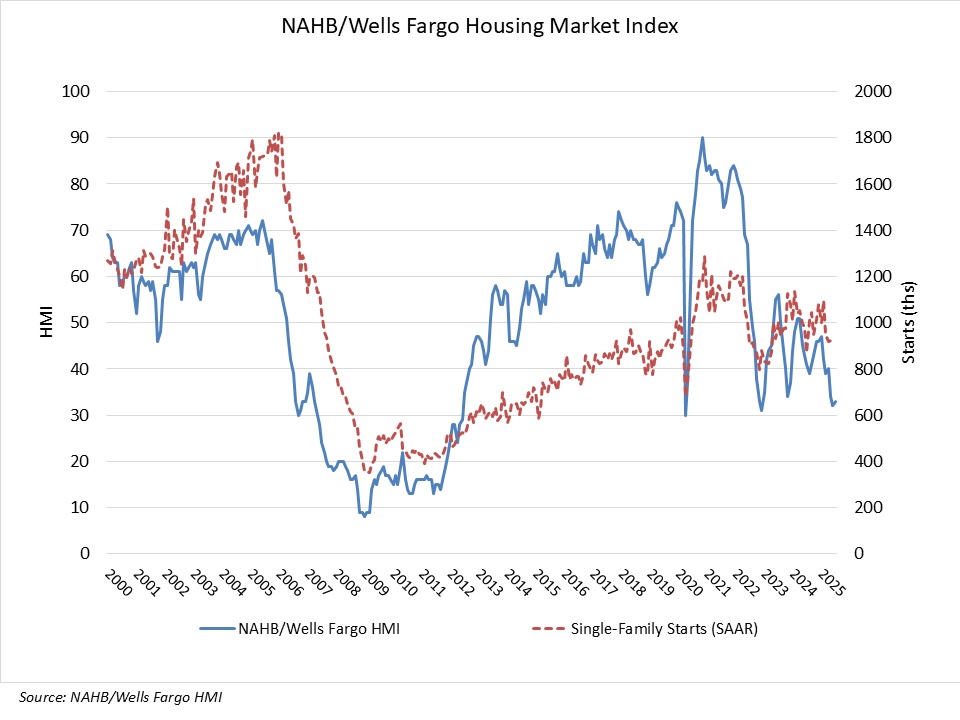

Builder confidence for future sales expectations received a slight boost in July with the extension of the 2017 tax cuts, but elevated interest rates and economic and policy uncertainty continue to act as headwinds for the housing sector.

Builder confidence in the market for newly built single-family homes was 33 in July, up one point from June, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). Builder sentiment has now been in negative territory for 15 consecutive months.

The July HMI survey revealed that 38% of builders reported cutting prices in July, the highest percentage since NAHB began tracking this figure on a monthly basis in 2022. This compares with 37% of builders who reported cutting prices in June, 34% in May and 29% in April. Meanwhile, the average price reduction was 5% in July, the same as itâs been every month since last November. The use of sales incentives was 62% in July, unchanged from June.

Consistent with ongoing weakness for the HMI, single-family housing starts will post a decline in 2025 due to ongoing housing affordability challenges per the latest NAHB forecast. Single-family permits are down 6% on a year-to-date basis and builder traffic in the HMI is at a more than two-year low.

Derived from a monthly survey that NAHB has been conducting for more than 40 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as âgood,â âfairâ or âpoor.â The survey also asks builders to rate traffic of prospective buyers as âhigh to very high,â âaverageâ or âlow to very low.â Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI index gauging current sales conditions rose one point in July to a level of 36 while the component measuring sales expectations in the next six months increased three points to 43. The gauge charting traffic of prospective buyers posted a one-point decline to 20, the lowest reading since end of 2022.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased two points to 45, the Midwest held steady at 41, the South dropped three points to 30 and the West declined three points to 25.

The HMI tables can be found atÌę.

Ìę